Your retirement plan publication is an essential resource that explains your NYSLRS benefits in detail — how long you’ll need to work to receive a pension, how your benefit is determined, what death and disability benefits may be available and more. You should consult it throughout your career, but it’s especially important to read as you prepare for retirement.

Finding Your Retirement Plan Publication

NYSLRS administers two retirement systems, six membership tiers and many retirement plans that are described in dozens of retirement plan publications. We want to make sure you find the specific retirement plan information that pertains to you, which is why we have a new tool to help you Find Your NYSLRS Retirement Plan Publication. To use it, you just need to know your retirement plan code. You can find your code in the ‘My Account Summary’ section of your Retirement Online account homepage, or check the second page of your latest Member Annual Statement. You also can also use the new tool to search for your plan publication by retirement system, tier and occupation type (uniformed or non-uniformed).

Looking Up Your Plan Milestones

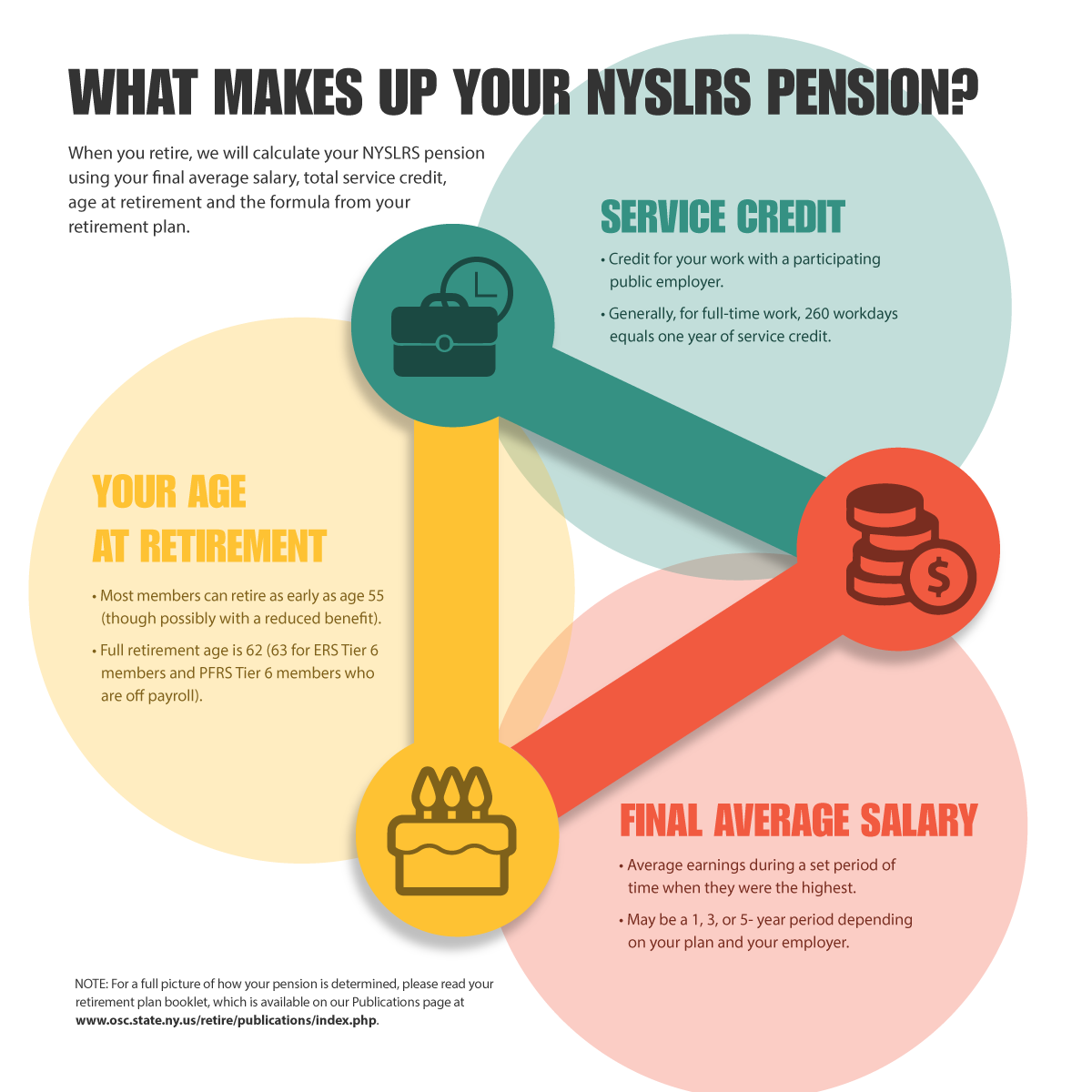

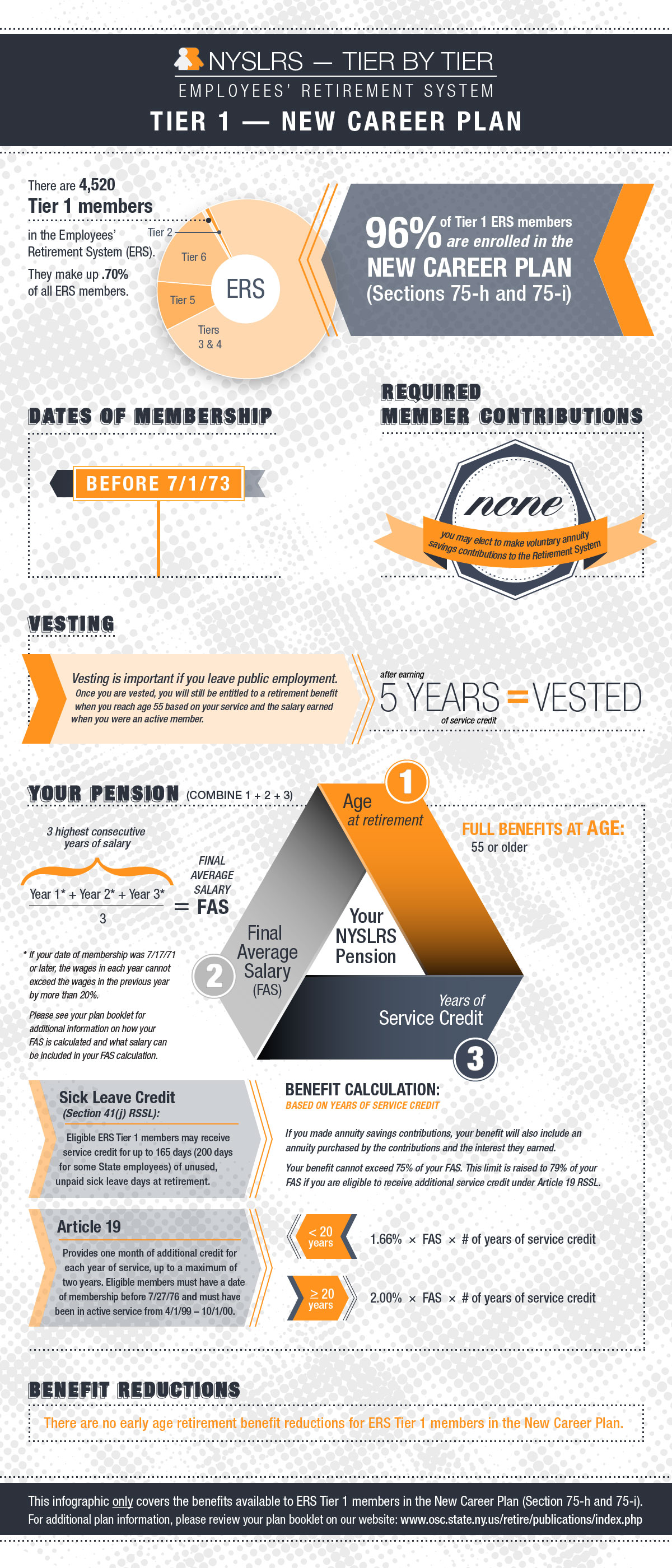

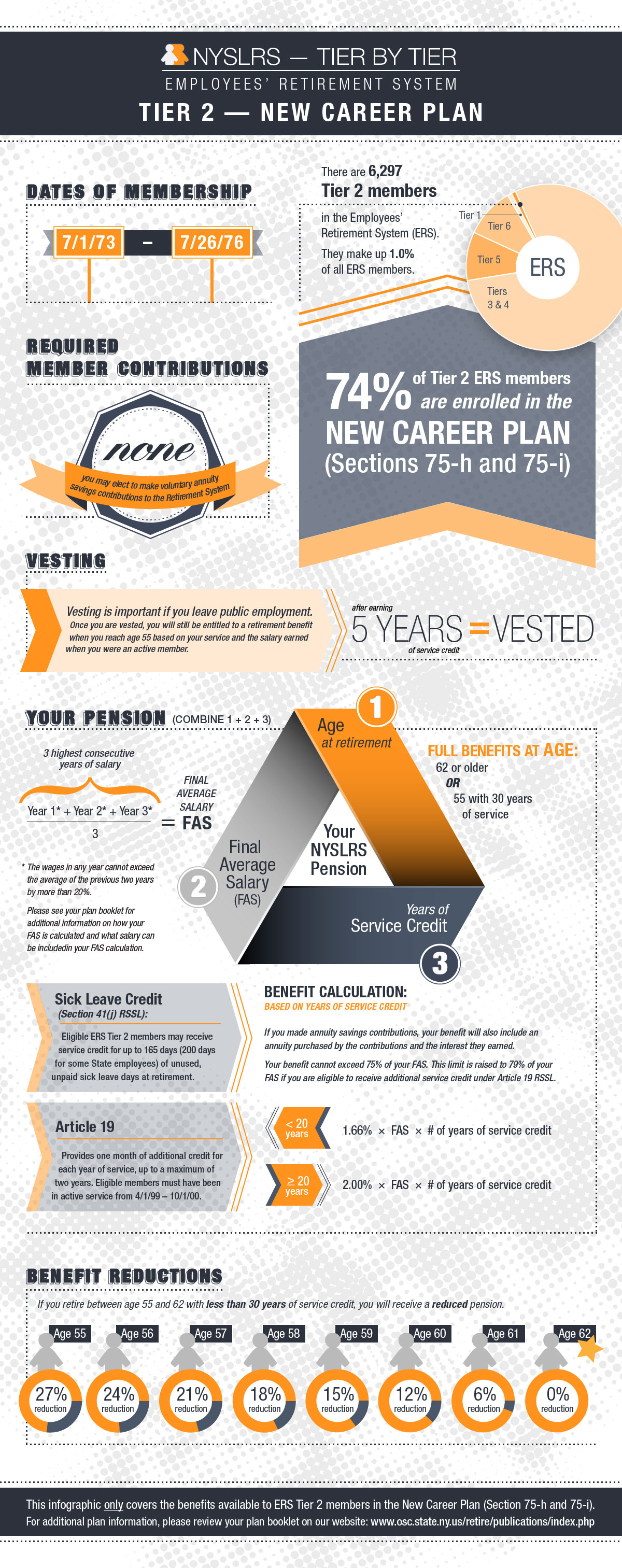

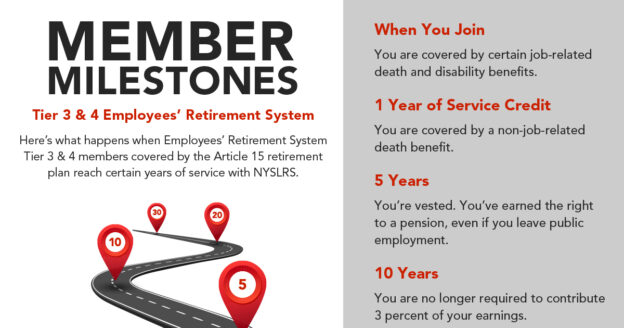

Once you have found your publication, check to see what minimum age or service milestones you’ll need to reach to receive your pension. Most retirement plans allow for full pension benefits at 62 (63 for Tier 6 members) or a reduced benefit starting at age 55. Members in some plans can apply for their pension once they reach 20 or 25 years of service credit, regardless of age.

The years of service credit you earn may also change the calculation of your pension. For example, the percentage of earnings used to determine your retirement benefit may increase once you reach certain milestones — such as when you have 20 years of credited service — but that depends on what retirement plan you are in.

Knowing your plan-specific age and service requirements can help you decide when to retire and anticipate the income your benefit would provide in retirement. If you want to work until a certain age or need to earn a specific amount of service, now you can set that goal and prepare accordingly.

For more detailed information on what you can find in your plan publication, check out our blog post, How to Read Your Retirement Plan Booklet.

Help for New Members

New NYSLRS members may also be interested in our New Member webpage. This page collects several resources that can help you understand your NYSLRS membership and pension.

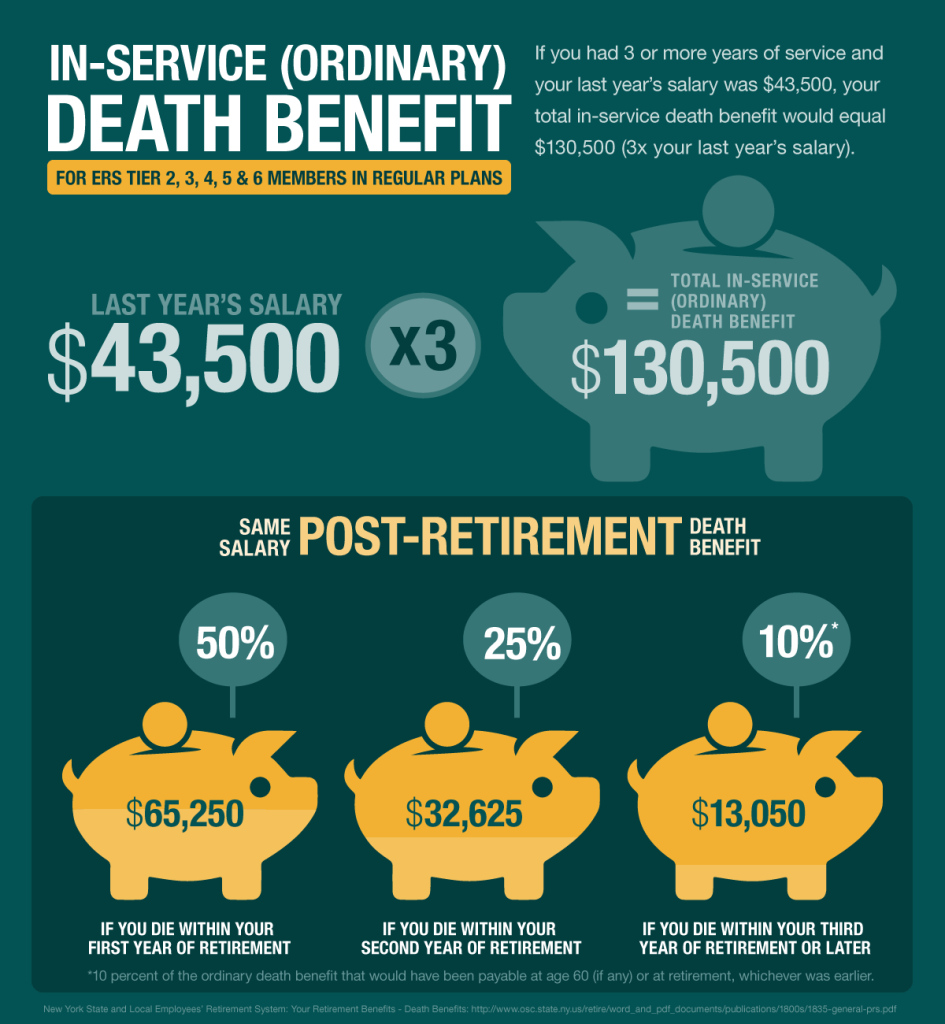

manages more than 300 retirement plan combinations for its members, which are described in more than 50 plan booklets. But, for all that complexity, they breakdown into just two main types: regular plans and special plans. Under a regular plan, you need to reach certain age and service requirements to receive a pension. For instance, if you’re a Tier 4 member in the Employees’ Retirement System (ERS) with a regular plan, you’re eligible for a benefit when you turn 55 and have five or more years of service credit. Most of our ERS members are in regular plans.

manages more than 300 retirement plan combinations for its members, which are described in more than 50 plan booklets. But, for all that complexity, they breakdown into just two main types: regular plans and special plans. Under a regular plan, you need to reach certain age and service requirements to receive a pension. For instance, if you’re a Tier 4 member in the Employees’ Retirement System (ERS) with a regular plan, you’re eligible for a benefit when you turn 55 and have five or more years of service credit. Most of our ERS members are in regular plans.