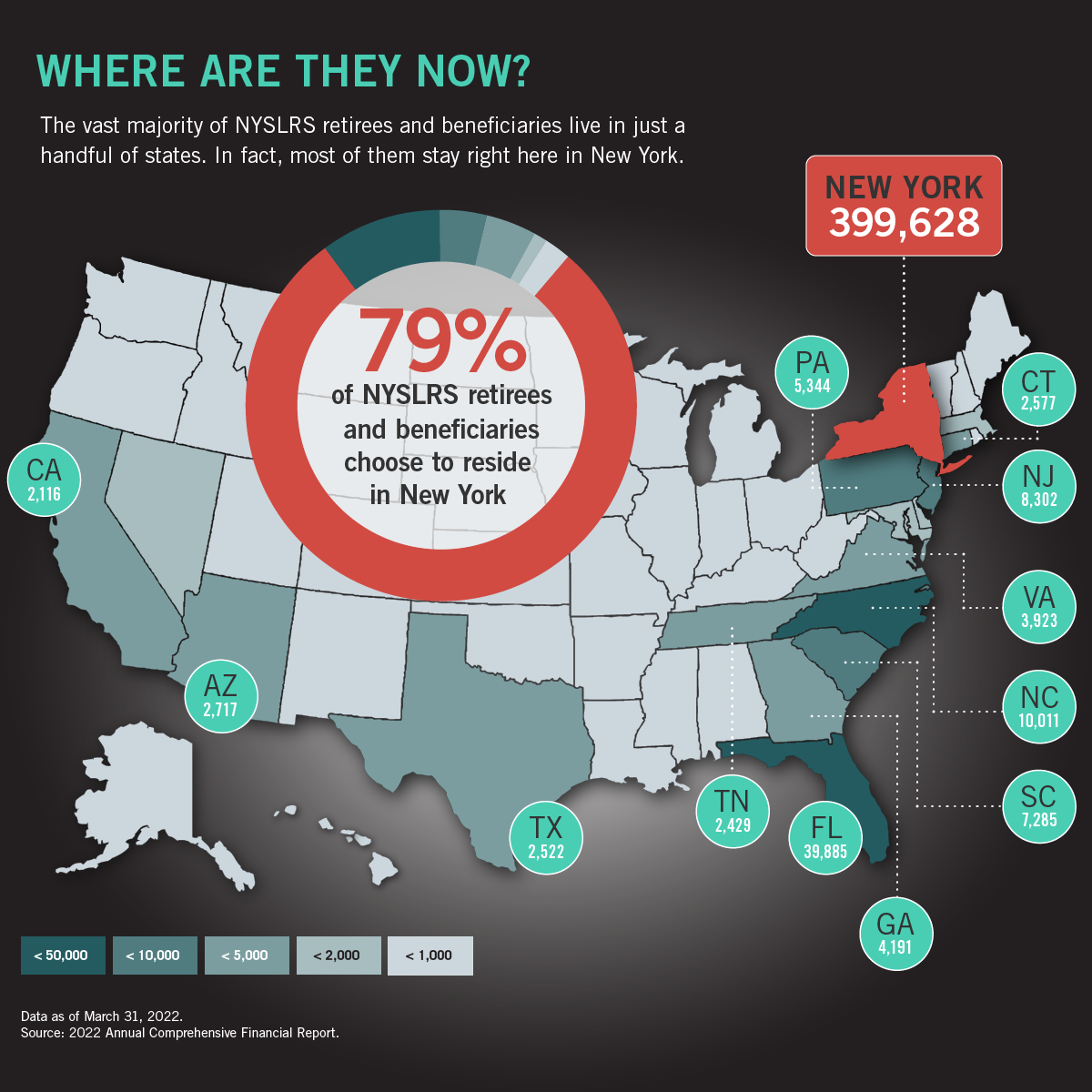

NYSLRS was providing pension benefits to 507,923 retirees and beneficiaries as of March 31, 2022.

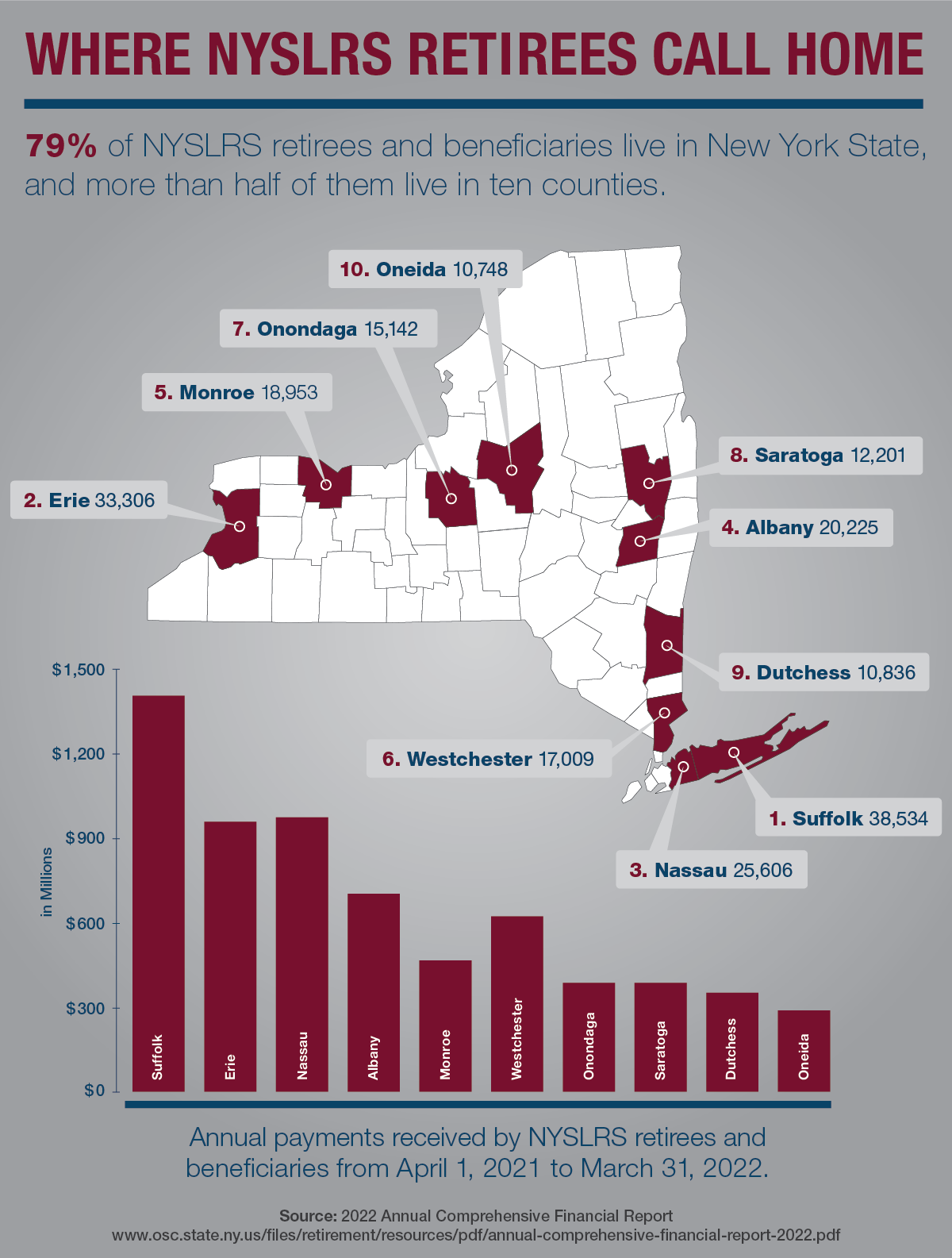

Nearly 79 percent of NYSLRS retirees and beneficiaries — some 399,628 — live right here in New York State, and they can be found in every region and county. The Capital District, for instance, is home to more than 64,000 retirees and beneficiaries, with roughly the same number living on Long Island.

These New York retirees live in our communities, and their pension money flows right back into our neighborhoods. Retirees in New York pay local property and sales taxes, and their spending supports local businesses, stimulates the economy and generates thousands of jobs.

NYSLRS Retirees in the United States

NYSLRS retirees can also be found in every state. Florida, not surprisingly, is the number two choice after New York, with nearly 39,885 calling the Sunshine State home. North Carolina is third, with 10,011 retirees, followed by New Jersey, with 8,302. North Dakota has the fewest, with only 20 retirees and beneficiaries. Another 646 live outside the United States.

Learn More

Extensive information about our retirees and members, the Common Retirement Fund and Fund investments can be found in our latest Annual Comprehensive Financial Report. This report, published each fall, has a wealth of information about the Retirement System, its investments, strategies and financial position. It also provides details about NYSLRS’ nearly 1.2 million members, retirees and beneficiaries.