When you joined the New York State and Local Retirement System (NYSLRS), you were assigned to a tier based on the date of your membership. There are six tiers in the Employees’ Retirement System (ERS) and five in the Police and Fire Retirement System (PFRS) – so there are many different ways to determine benefits for our members. Our series, NYSLRS – One Tier at a Time, walks through each tier and gives you a quick look at the benefits members are eligible for before and at retirement.

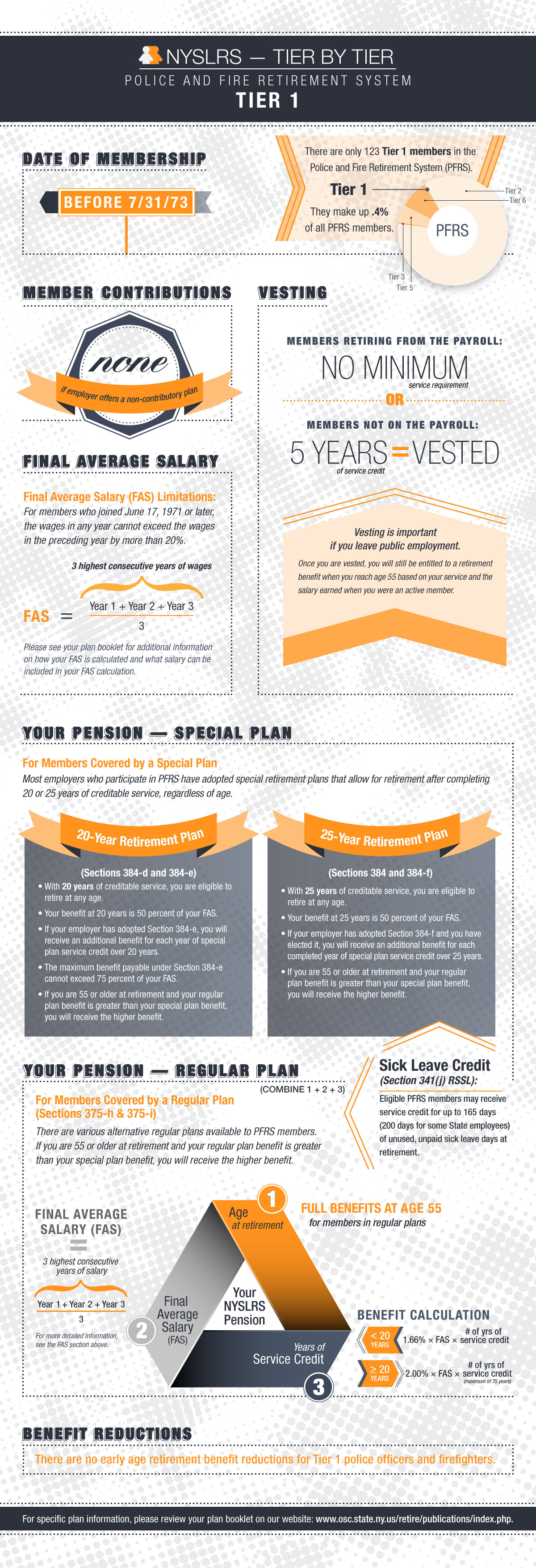

Today’s post looks at Tier 1 in the Police and Fire Retirement System, which has only 123 members. PFRS Tier 1 represents the smallest percentage – 0.4 percent – of NYSLRS’ total membership.

If you’re a PFRS Tier 1 member, you can find your retirement plan publication below for more detailed information about your benefits:

- State Police Plan for PFRS Tier 1 Members (Section 318-b) (VO1518)

- New Career Plan for PFRS Tier 1 Members (Sections 375-h and 375-i) (VO1515)

- Career Plan for Tier 1 Members (Sections 375-f and 375-g) (VO1642)

- Police and Fire Plan for Tier 1 Members (Sections 375-b and 375-c) (ZO1512)

- Non-Contributory Plan with Guaranteed Benefits For Tier 1 Members (Section 375-e) (ZO1513)

- Basic Plan with Increased-Take-Home-Pay (ITHP) For PFRS Tier 1 Members (Sections 370-a, 371-a & 375) (ZO1511)

- Regional State Park Police Plan For Tier 1 Members (Section 383-a) (VO1867)

- En-Con Police Officers Plan for Tier 1 Members (Section 383-a) (VO1822)

- Forest Rangers Plan for PFRS Tier 1 Members (Section 383-c) (VO1864)

Be on the lookout for more NYSLRS – One Tier at a Time posts. Next time, we’ll take a look at another one of our ERS tiers. Want to learn more about the different NYSLRS retirement tiers? Check out some earlier posts in the series: