When it comes to managing your NYSLRS account, Retirement Online is the fastest way to do it. Skip printing forms, having them notarized and sending them through the mail — when you submit your requests online, NYSLRS has them immediately and your changes will be completed more quickly. It’s convenient, and it’s secure.

Here’s a look at some of the things NYSLRS members (not yet retired) can do online.

View Your Account Information

Sign in to Retirement Online for easy access to key information to help you plan for retirement. On your Account Homepage, you can find your date of membership, tier, retirement plan (which you can use to find your retirement plan publication), estimated total service credit and more.

Change Your Delivery Preference to Email and Help Us ‘Go Green’

Save time and reduce paper waste — help us ‘go green’ by choosing the paperless option. When you choose to receive information from NYSLRS electronically, we will send you an email when important documents and letters are ready to view in Retirement Online.

It’s easy to make the switch:

- Sign in to Retirement Online.

- From your Account Homepage, click the “update” link next to ‘Contact by’ or ‘Member Annual Statement by.’

- Choose “Email” from the dropdown menu.

If you choose “Email” as your delivery preference, you will not receive a printed copy in the mail.

Update Your Contact Information

It’s important that we have your current contact information so you receive the news, letters and statements that we send you. You can update your email address, mailing address and phone number in the ‘My Profile Information’ section of your Account Homepage. Just click “update” next to the item you’d like to change. Use a personal email address that you will have access to before and after you retire, rather than a work email address.

View and Update Your Beneficiary

NYSLRS retirement plans provide death benefits for beneficiaries of eligible members who die before retiring. It’s a good idea to review your beneficiaries from time to time to make sure your choices reflect your current wishes. Retirement Online is the fastest way to add or remove beneficiaries or update their contact information. Click the “View and Update My Beneficiaries” button to get started.

Estimate Your Pension

How much will your pension be? It’s an important question as you’re planning for retirement. In just a few steps, most members can estimate their retirement benefit based on up-to-date account information, then save or print the estimate. Entering different dates and comparing the results can help you choose the retirement date that’s right for you. From your Account Homepage, click the “Estimate my Pension Benefit” button.

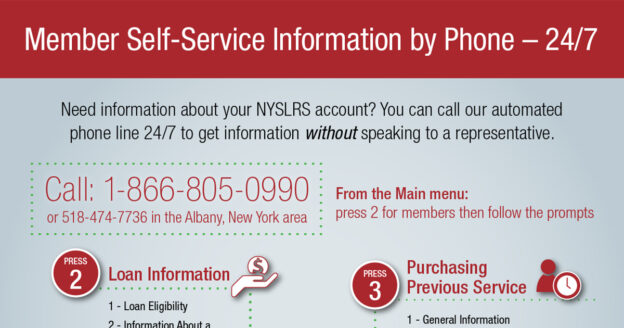

Apply for a Loan and Manage Loan Payments

It’s easy to apply for a loan in Retirement Online. If you are eligible to take a loan against your retirement contributions, you can see how much you can borrow, your repayment options and whether your loan will be taxable — all before you apply. Click the “Apply for a Loan” button to start an application.

If you have an existing loan, you can click the “Manage My Loans” button to adjust your payment amount or to make an additional one-time payment.

Request Credit for Previous Service

If you worked for a participating public employer before joining NYSLRS, or if you served in the U.S. Armed Forces, you may be able to purchase service credit for that time. Click the “Manage My Service Credit Purchases” button to request credit and upload any supporting documentation.

Purchase previous service credit as soon as possible. It’s cheaper and will make it easier to calculate your final monthly pension payment.

Get Your Member Annual Statement Faster

Your Member Annual Statement can help you understand your benefits. It’s a snapshot of your NYSLRS account based on the information we have on file for you as of March 31 each year, the close of our fiscal year. Statements will be available online in the spring, sooner than printed copies will be mailed — update your delivery preference to “Email” to get notified when it’s available online.

Generate a Mortgage Verification Letter

If you need to provide proof of your NYSLRS account information for a mortgage, you can get your own income verification letter online. From your Account Homepage, in the ‘I want to…’ section at the top right, click the “Generate Income Verification Letter” link. You can print a document that shows your contribution balance, and — if you have an outstanding loan — the date of your last loan, the current balance and the interest rate.

Apply for Retirement

When you are ready to retire, Retirement Online allows you to skip the hassle of mailing paper forms or visiting our office. You can apply for a service retirement benefit, choose your pension payment option, sign up for direct deposit and submit retirement-related paperwork online. A big advantage of applying online is that you don’t have to get anything notarized. Read our blog post about applying for retirement for more information and links to resources.

Other Online Transactions

If you previously were a member of another New York State public retirement system before joining NYSLRS, your service could be recredited and your date of membership and tier restored. You can click the “Reinstate a Previous Membership” button to get started.

If you leave public employment with less than ten years of service credit, you can use Retirement Online to withdraw your membership. However, this will terminate your membership with NYSLRS. If you have any questions, speak with a customer service representative before you submit your withdrawal application. You can message them using our secure contact form.

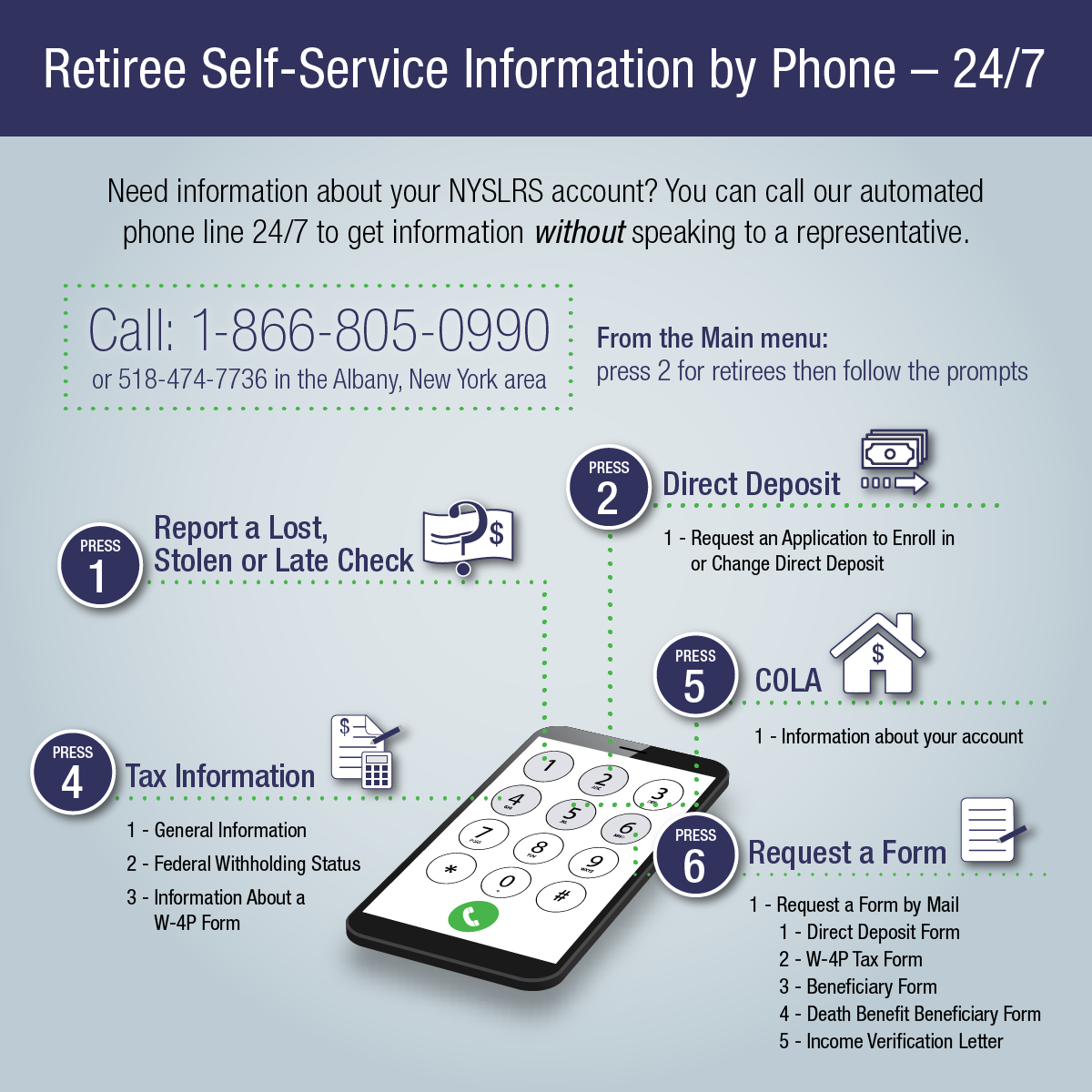

Retirement Online After You Retire

Retirement Online will continue to be an essential tool throughout your retirement years. To learn more, check out how Retirement Online for Retirees Keeps Getting Better.